Delta Exchange crypto trading platform is a well-known platform which allows support for futures and derivatives trading. It allows users to purchase and sell futures contracts for more than 50 DeFi coins and altcoins. With its features, experienced traders are attracted more because they can leverage their positions and earn higher returns.

Users can also create a demo account to practice trading using virtual coins. Delta exchange provides this feature especially for those users who are beginners and want to know about the platform while testing different trading strategies. This doesn't risk losing real money.

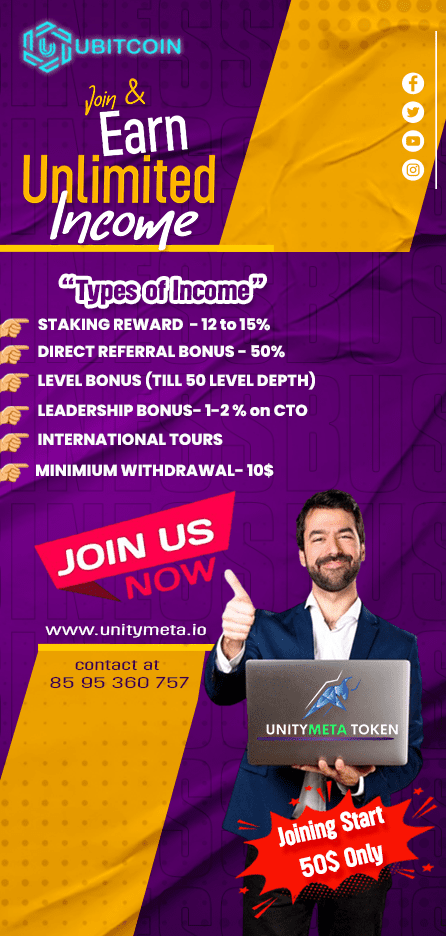

Users can easily stake various cryptocurrencies that allow them to earn profits on the coins they hold. With these features, the exchange becomes more appealing to the users who want to stake their tokens and get a passive income. Investors who have the native token of Delta Exchange, DETO, get more benefits such as unlimited withdrawals with zero fees.

There is an Insurance Fund provided by Delta crypto exchange which can be used if the platform is not able to close a liquidation position before it breaches the bankruptcy price. All the acquired positions are closed by the liquidation engine at a loss of 5% for Bitcoin and Ethereum contracts and at a loss of 2% for other contracts.

Crypto Derivatives Trading: This platform ensures that investors get a wide variety of crypto derivatives including options, futures, and perpetual swaps.

Leverage Trading: With leverage trading, users can maximize their potential gains by trading a larger position than their initial amount.

Automated Trading Bots: There are automated trading bots in the platform that enable users to execute their trading strategies without intervening manually.

Staking and Yield Products: With Delta Exchange trading app, users get staking services and yield-generating products that allow them to earn passive income for the crypto they hold.

Even though Delta exchange and Binance crypto exchangeare both great crypto trading platforms and are somewhat similar, there are a lot of other differences:

Binance offers spot trading and margin trading where users can trade with a leverage of 3x to 5x. It also offers Futures trading where P2P trading functionality is used. Users can also leverage the Binance Leveraged Token for up to 4x. It offers various order types including Limit, Market, Stop Limit, Stop Market, Trailing Stop, Post Only, and TWAP. It is also mandatory for users to complete their KYC to withdraw funds or start trading.

Whereas, Delta Exchange provides Options trading and perpetual trading with a leverage of up to 100x. It also offers spot trading. The order types that it offers to users are Limit, Market, Conditional, Stop Limit, Stop Market, Taker Profit Market, Take Profit Limit, and Trailing Stop.

For trading on Delta exchange crypto trading platform, users get cryptocurrency and future contracts. Futures trading is basically a legal agreement between two parties for buying and selling any asset at a price that has already been set at a certain time in the future. Due to this, it is easier for traders to speculate if the price of a cryptocurrency will go up or down to open a position. There is a fixed maturity date on every Futures contract whereas there is no expiry date on perpetual contracts.