Binance exchange is an online exchange for trading cryptocurrencies. There are hundreds of most famously known and traded cryptocurrencies that Binance supports. It also provides a crypto wallet to the traders so that they can store their electronic funds.

This exchange platform supports various services where users can earn interest or make transactions using cryptocurrencies. There are also programs that miners and traders can use to make important investment decisions.

In the Binance cryptocurrency exchange service, there is a blockchain-based token of their own i.e. BNB. The global presence of Binance makes it a great option but it is limited in some countries such as the United States and U.K.

Binance is a very comprehensive platform which offers a bunch of services that users can take benefit from:

Spot Trading – There is a spot trading feature that allows users to trade in a wide range of cryptocurrencies where they can buy and sell assets at the market price.

Margin Trading – The margin trading feature provided by Binance exchange app allows users to borrow funds and trade with them. THis increases their potential profits as well as losses.

Futures Trading – The futures trading platform by Binance gives users the permission to trade cryptocurrency contracts with leverage.

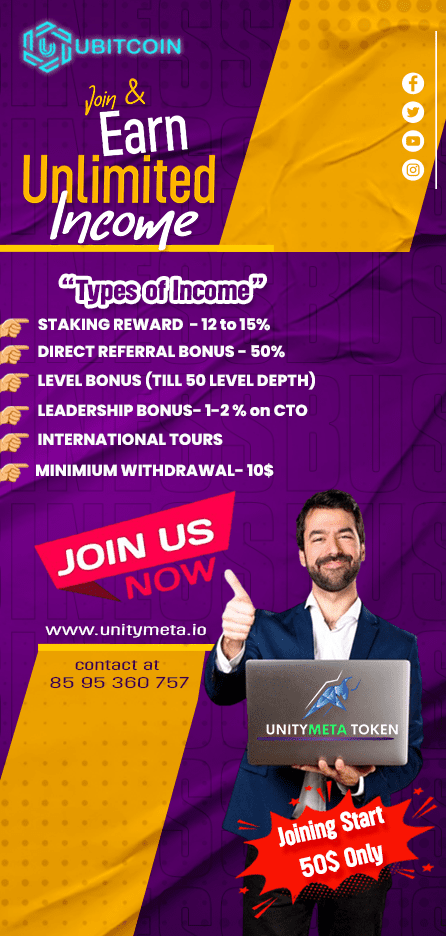

Binance Staking – There are staking options provided by Binance for a few cryptocurrencies that allow users to hold their assets on the platform and earn reward for it.

Savings – Explaining the Binance application details for the savings feature. There are various savings products such as flexible and fixed-term savings accounts so that users can earn interest on the cryptocurrencies they are holding.

Binance Launchpad – By availing the Binance Launchpad services, it becomes easier for users to participate in the ICOs.

Binance Academy – Learn about cryptocurrencies and blockchain technology with the help of the Binance Academy.

Binance Card – Get a debit card to spend your cryptocurrency at merchants where Visa is expected.

Binance and Coinbase are both cryptocurrency exchange platforms which provide various features to the users. Comparing both the platforms based on a few features:

Fees: Binance offers the lowest possible fees in the industry where spot trading is at 0.1% and on Binance U.S., Bitcoin trading fees is zero. However, Coinbase charges a fee from 0 - 0.60% for makers and takers.

Cryptocurrencies: There are over 600 cryptocurrencies supported globally by Binance crypto app whereas Coinbase supports over 200 crypto coins. Coinbase offers a variety of options for mainstream as well as niche market participants.

User Interface: The user interface of both the cryptocurrency exchange platforms is easy-to-navigate which is useful especially for beginners. There are easy sign-up processes and intuitive usage with educational material for users to get knowledge about the important concepts.

Security: Binance crypto exchange platform applies a two-step verification process, device management, address whitelisting, FDIC-insured balance with USD.

Binance crypto exchange has various services that it offers for trading, listing, de-listing, fundraising, and withdrawing cryptocurrencies. Major crypto enthusiasts who want to launch their tokens have the option to use Binance applications to do so and raise funds through initial coin offerings.

This crypto exchange platform is used by millions of traders to exchange and invest in various cryptocurrencies.

There is a necessary KYC that needs to be completed before users can start trading. Once users successfully create their account and add funds to their wallet address, they can start trading,

Binance crypto exchange app supports four types of trading orders including market, limit, stop-limit, and once-cancels-the-other. With the market orders, they are executed instantly at the best price available in the market.

Limit orders will only be executed at the limit price that the trader sets. The stop-limit order is the one which becomes valid when the price reaches a specific level. Lastly, the OCO order is basically a pair of orders where the order that is executed will cancel the other one.